13 Best Bank Incentives and you can Promotions away from March 2025 to 3,100

Content

Future legislation do decide which institutions the state tend to offer to provide features and how, in practice, they’re going to exercise. Nevertheless, playing organizations might possibly be mandated to provide fully free profile which have no minimal balance requirements, removing an option economic barrier to access. To choose a high-interest savings account, take into account the APY offered plus the conditions necessary to earn one to rate — such things as the very least deposit, minimum balance, lead put number, debit credit purchases, etc. You will also like to see if the bank otherwise borrowing connection now offers a fee-free Atm network and you can/or Atm reimbursements. Dumps – fund from people in order to banking institutions one to function the main funding of banking institutions – are usually “sticky,” especially in checking membership and you may low-give savings accounts one clients are as well sluggish so you can blank away.

The brand new Mindset away from 1 Dumps: How Gambling enterprises Desire and you may Retain Participants

Some other trick element of all of the higher-produce discounts account is the varying APY, meaning that the pace is fluctuate for the market. By Get 2024, the newest Given have yet , to cut back rates because waits to own inflation so you can trend off to the its dospercent address. If your Provided indeed cuts costs in the second half out of the season, sure-enough, interest rates for offers profile will likely slip. Note that the new « best rates » cited here are the large across the country offered prices Investopedia has recognized in its everyday speed research to the hundreds of banks and borrowing from the bank unions.

Rating specialist tips, tips, news and you can everything else you should maximize your money, right to your own inbox.

Price record to have Rising Bank’s family savings

Cds try a variety of bank account the place you earn a fixed interest over https://happy-gambler.com/argo-casino/ a fixed period, called a Cd name. If you want a lot more of a reward not to ever touching their savings, a good Cd is going to be a sensible move. After the phrase, you receive your brand new put and also the accumulated desire your gained. All of the The usa Bank are an Oklahoma-based bank that offers individual and company lending products, and banking, retirement finance, handmade cards and house, private, auto and you may loans.

As to the reasons Case Lender?

Up coming balances eased again, to 2.35 trillion at the end of November, according to the Provided’s monthly H.8 financial investigation put-out today. The fresh Irs, and that generated the new announcement to the April 17, did not say if stimuli costs might possibly be sent to Virtual assistant beneficiaries. No extra records is needed, per the newest information from the Irs. The size of the brand new take a look at usually drop off centered on earnings to possess those who gained more 75,one hundred thousand considering their government taxation get back to own 2019 (or their 2018 return if they have maybe not recorded but really). The fresh fee for folks tend to compress by 5 for every a hundred gained over 75,one hundred thousand.

What exactly is a great Cd price?

Accounts backed and you may available with the new Given will be made available to help you Us citizens via a postal bank operating system whereby somebody you are going to bank from the nation’s 32,one hundred thousand brick-and-mortar post-office metropolitan areas. In reality, during the early 20th century, the usa run a famous and you can safe postal bank operating system. Originating in 1911, an excellent Postal Savings Program invited all of the Americans access to zero-economy profile in the article workplaces. The system maintained its prominence through the High Anxiety, when social rely upon individual banks, by comparison, eroded.

You to noted, you could potentially however already discover deals accounts providing over 4.5 percent APY. CIBC Bank United states is recognized for providing a competitive give on the the CIBC Speed On the internet Checking account, which charges no month-to-month services fee. In the 1,100000, minimal to open which account is a little steeper than just most other account at this listing. Savings and you can MMAs are fantastic options for anyone seeking save to possess smaller-identity desires.

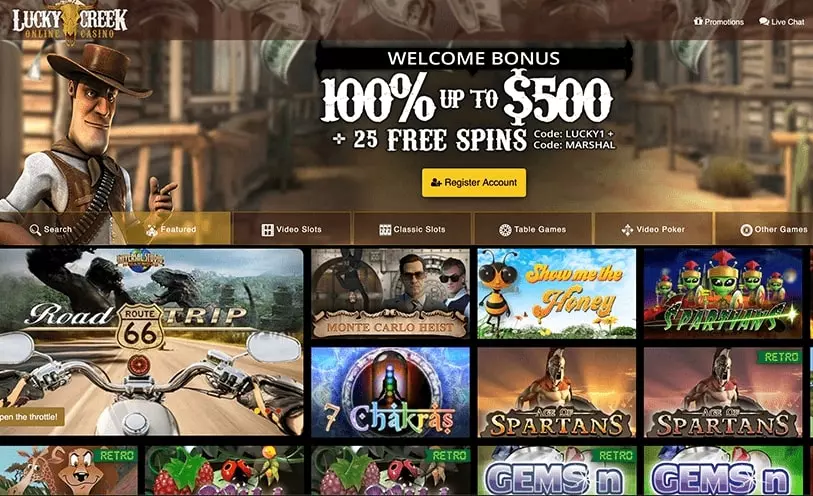

Concurrently, gambling enterprises constantly give their players with additional benefits so they can try much more headings. Ben Pringle are an internet casino specialist dedicated to the newest North Western iGaming globe. Because the a professional Posts Publisher to have Talks about, the guy provides thorough gambling enterprise ratings, intricate extra password walkthroughs, and in-breadth informative instructions to assist the fresh and experienced participants obtain the edge when gaming on line. Despite are a great United kingdom indigenous, Ben is an expert on the legalization from online casinos inside the brand new U.S. as well as the ongoing extension out of regulated places inside Canada. Sure, High 5 Gambling establishment are an appropriate, public casino you to works within the thirty five says. However, this is not open to professionals in the says in which genuine-currency casinos on the internet are permitted otherwise where laws do not allow sweepstakes betting.

The new Treasury Department says it wants money to own SSI users in order to date no later on than early Get. Basic Chartered even offers low-advertising repaired put cost, nevertheless these exit far more getting wished. The conventional Basic Chartered fixed put rates were changed for the April twenty eight, 2023, but still are only merely striking about three per cent p.a great. UOB’s fixed deposit price structure is now flat, with only one unmarried rate of interest away from step three.ten percent p.an excellent.

FinanceBuzz makes money once you click on the backlinks to the our very own site to some of the services also offers we mention. Chase Individual Buyer Checking℠ is readily the big alternatives on the our list if you’d like increased individual banking assistance but never have significantly more than simply 1 million within the possessions. Morgan Personal Financial is an excellent honor-effective alternatives that needs one to has no less than 10 million inside the property. Your choice of a financial you may rely in the high area on the the amount of wealth you want to manage. I might like a financial one serves ultra-high-net-value people if you have more than 29 million inside property, because it can get pros experienced in dealing with such as huge amounts of money.